On national television, the President of the Republic, Gabriel Boric, announced the pension reform to be introduced by his government, detailing that the project includes a mixed system, individual accounts and the end of the PFAs.

The president began by explaining that “the main objective of this reform is to increase the amount of pensions as soon as it becomes law”, assuring that this reform “will protect principles that are valuable” for citizens.

“It will reward and recognize the effort of work throughout life. Secondly, and to dispel any phantom or false news, pension savings in individual accounts, both accumulated and future, will maintain individual ownership and will never be expropriated,” explained the head of state.

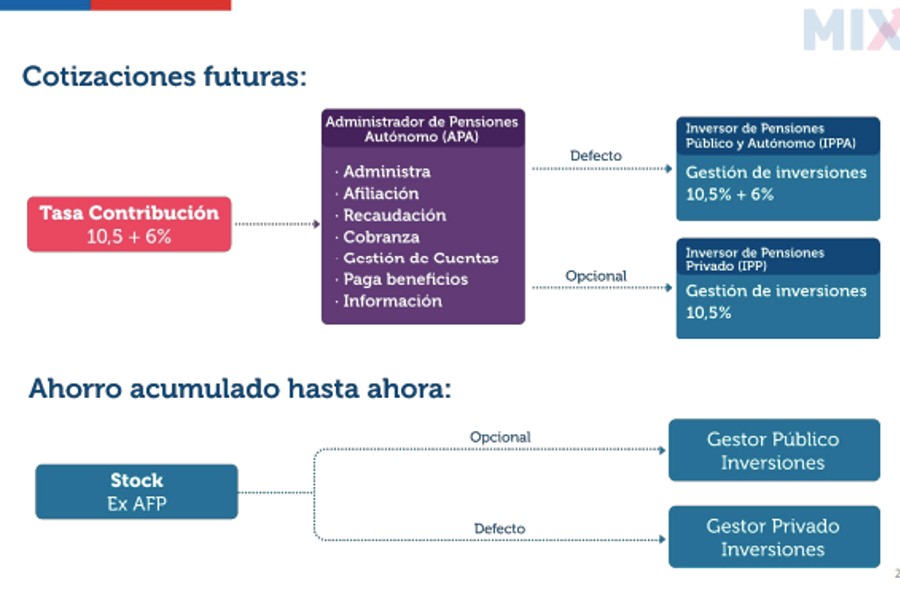

In addition, the president explained that in this new system there will be “freedom to choose who will invest your pension funds, an option that does not exist today, as we are all obliged to be in an AFP”.

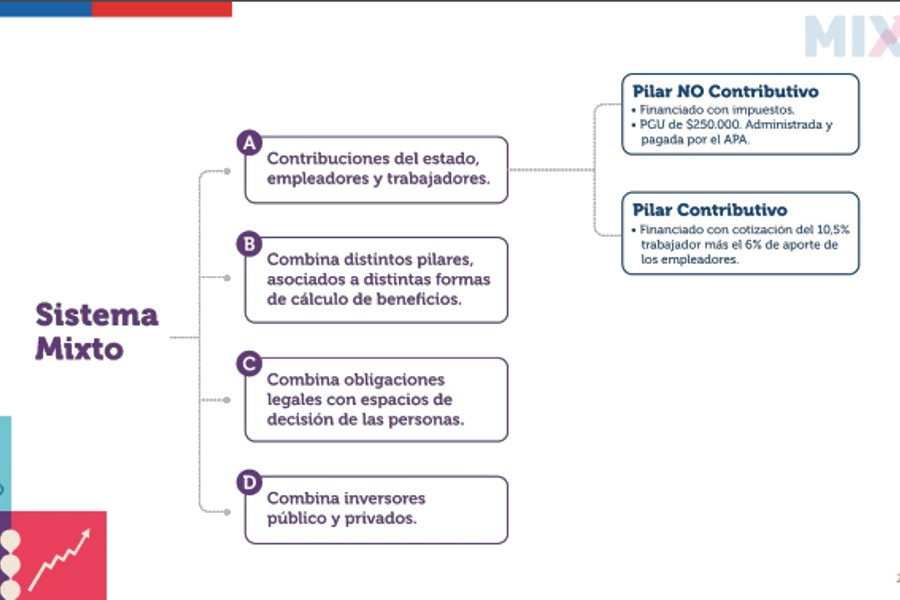

To this end, he explained that the reform is creating “a mixed pension system, based on the principles of social security in which the state, employers and workers all contribute. We want to leave behind in this way an extreme system, which has not been able to meet the expectations that were placed in it and which has recognized shortcomings”.

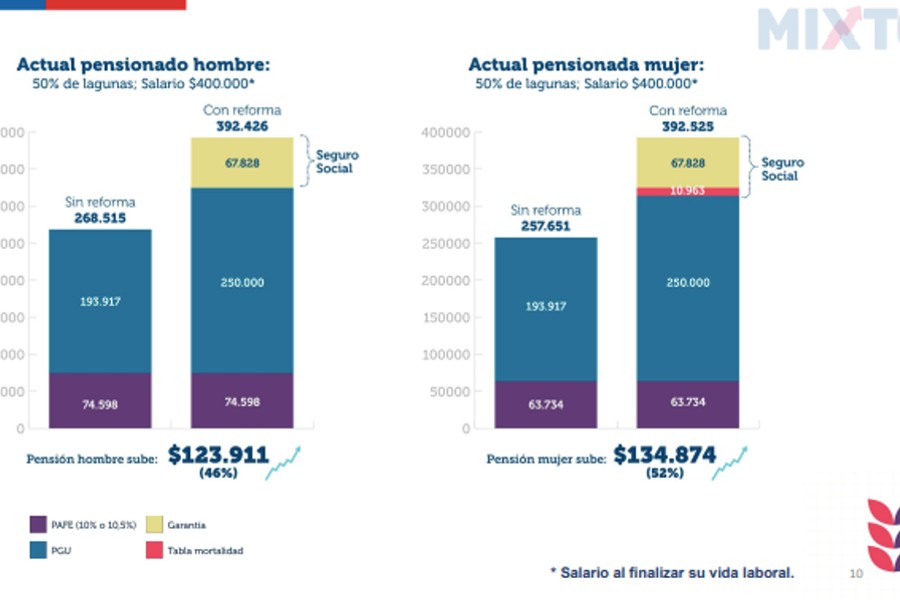

“For example, a woman or a man who contributed half of their working life with a salary of 400,000 pesos, today receives a pension of 257,000 and 268,000 pesos, respectively. If this reform is approved, the pensions of both will immediately exceed 390,000 pesos, increasing by more than 124,000 pesos, or 46% more, for men and 134,000 pesos, or 52% more, for women. I reiterate, to be clear, they would go from a pension of 260,000 pesos to one of 390,000 pesos,” he added.

Boric also addressed the factor of the AFPs in this reform, assuring that if the bill is approved, they will come to an end.

“During the last few years, there has been a long debate about the AFPs. Chileans are tired of the abusive commissions and losses generated by the current system. The AFPs, in this reform, are coming to an end. There will be new private investment managers with the sole purpose of investing pension funds and, in addition, there will be a public alternative, which will promote competition with the entry of new players,” he said.