Published on Thursday, 23 January 2014 00:39 by Critical Thinking

The World Economic Forum at Davos this week is discussing inequality. NBC News declared: “With the global economy slowly getting back on its feet, 2,500 delegates gathered in Davos, Switzerland face a vexing question this week: How to spread the wealth.” This is in the same week that Oxfam released a report which revealed the richest 85 people in the world own wealth equivalent to that owned by the poorest 3.5 billion, approximately half the global population. Expressed another way: 0.00000000017% of the world’s population own the same as the poorest 50%. It throws the Occupy slogan of “We are the 99%” into sharp relief.

Accelerating inequality is a function of the economic system and is driven by three fundamental flaws which, if not addressed, render all other remedies impotent and will result in the collapse of the economic system. These flaws have been embedded over centuries, to serve the interests of those who shaped the banking and economic system, the ruling elites. These crucial flaws ensured (and ensure today) these elites, who already hold power and wealth, not only hang on to it but tilt the “playing field” ever further in their favour granting them ever more, in a system which drives wealth from the poorest to the richest. No regulation or “change of culture” can withstand the tsunami of self-interest embedded in the system which drives inequality, unsustainable growth, competition, conflict and environmental destruction. It fosters a culture of “cheating” and corruption leading to outright fraud. Perverse incentives abound to bury information and “work the system” for self-interest. It’s not a conspiracy, it’s the collusion of vested interests.

JP Morgan Chase is facing charges that run into hundreds of pages and has already racked up “fines” (a cost of doing business which is a minor inconvenience when your bank is “too big to fail”) of some $23 billion. Yet neither the incredibly wealthy CEO nor any other senior executives have faced criminal charges – they are “too big to jail”. Barclays, Goldman Sachs, Deutsche Bank and many other banks are similarly crime ridden. Many executives of these banks will be at Davos shaping the future for the ruling elite. These same interests are driving “so called” free trade agreements, negotiated in secret, such as the TransPacific Partnership (TPP) and the Transatlantic Trading and Investment Partnership (TTIP) which are probably also on the agenda at Davos. What is the purpose of these secret, anti-democratic agreements?

To lever open economies to corporate exploitation, attacking health, social and environmental protection. In short, TTIP and TPP are weapons of oppression and wealth extraction. The perpetrators of these crimes may or may not be criminally inclined but the system actively encourages this institutionalised cheating culture – getting one over the rest of humanity. Like goldfish who have no concept of the water they live in; most bankers and economists have no understanding of this fundamentally abusive system which drives their behaviour, nor do most other people.

Just to make sure you can’t see behind the curtain, economics has evolved with a contrived complexity which few understand and even those that claim to, may understand the mechanics but have no idea of the inevitable adverse consequences. They are wilfully ignorant of the coming crisis which will make 2008 look like a warm-up. Interest is the fundamental driver of our banking and economic system and is a primary culprit in driving inequality. The abusive, exploitative nature of interest has been understood for millennia. It is no accident that the major religions prohibited usury – lending money at interest. Simply put, it allows those with more money than they need, to exploit those who need it. And it gets worse: the establishment of the privately owned Bank of England in 1694 created the interest based money system which prevails today. It encourages private banks to create money from nothing and charge us interest for the privilege of using it, thus enslaving us all in debt, both public and private.

Margrit Kennedy, who sadly died late last year, wrote Interest and Inflation Free Money in 1995 and drew on data for West Germany over previous decades. She found everyone pays interest. When you buy a railway ticket, within the cost is the interest element levied on the capital investment to provide stations, track and rolling stock. Similarly, when you buy food, the cost includes interest on the investment in buildings, plant, machinery and transport. Kennedy also found that interest treats people differently. She divided the West German population by income and analysed the interest they paid and received. She found the bottom 80% of the population paid twice as much interest as they received but the top 10% received twice as much interest as they paid. ie. The lowest four fifths of the population paid all their interest to the top 10%. And the top 0.01% received 2,000 times what the top 10% received on average.

The interest system drives inequality; it is unavoidable. This is why the richest 85 people own as much as the poorest three and a half billion. Kennedy also found that the ability to pay the interest diminishes over time. Over the period 1968 to 1989, West German wages and national income rose by less than 400% but interest on national debt rose by a whopping 1,360%. ie. Debt interest rose much faster than the income to pay it. Debt grows exponentially, it is built into the money system. Interest on money discounts the future which is why we’re depleting our resources and damaging the environment at an accelerating rate. Future returns are calculated with reference to (interest based) Discounted Cash Flow (DCF) which means for example, a forest is worth more as logged timber today than left standing for future generations.

Environmental destruction is an inevitable consequence of the interest based money system because we demand a “time value” for money. Eradicating interest from our economic system would be a start but it is not sufficient to expunge the embedded cheating in our society. Henry George wrote in Progress and Poverty (1879) how vibrant economic progress in America was always accompanied by abject poverty. Many years study showed the underlying cause was the private appropriation of land and resources which are gifts from nature and whose value is created by the community but captured by parasitical landowners. He proposed a 100% land value tax, an idea adopted by Lloyd George and Winston Churchill which would remove the necessity to tax employment and enterprise. But the idea was quashed and suppressed, from public and academic discourse, by vested interests, ie. Landowners. More recently, Fred Harrison, who has spent 40 years studying and promoting the work of Henry George, wrote The Traumatised Society in which he describes how progressive dispossession from our land birthright by force has eliminated our ability to think clearly. He explains how the process of dispossession began five centuries ago when Henry VIII confiscated the monasteries, prior to which virtually 100% of the surpluses from the land were available for the public purse. Following the enclosures of common land, by the early 19th century, less than 4% was levied from land for the common good.

A tax “on the honest man” was introduced to make up the shortfall, ie. income tax. In the early 1990s, Harrison urged Boris Yeltsin to retain land in common ownership but banking interests prevailed, allowing Russia’s land and resources to be appropriated and exploited by global corporations and former public servants who became oligarchs. The other major flaw stems from the industrial revolution, that paid employment is a prerequisite for the means to life. Once people had been dispossessed of the land and the means to house, clothe and feed themselves, they were driven into factories in order to survive.

Landowners and parasitical collectors of interest gain an extraordinary share of the total wealth by exploiting those who create it. Since the industrial revolution, productivity growth has rendered full employment undesirable, unachievable and unnecessary. We are now in the position of having to create jobs that are destructive, without real purpose or just bureaucracy gone mad. The progressive monetisation and bureaucratic control over the lives of individuals, combined with having to work long hours to survive, has limited the opportunities to think, congregate and discuss how to create a better world for us all and future generations.

The media, controlled by the few, ensure we don’t question the way things are too deeply. Information is suppressed or corrupted to fit the narrative of vested interests. We are seduced into thinking that changes of government will make a difference but both sides are working within the framework of the dominant economic system, controlled by the few. Politics is reduced to puppet theatre. The business cycle is a product of these two flaws: land speculation and interest on money drive boom and bust. Many think we’ve just had our “bust” and are looking forward to the “boom”. Sadly, they will be disappointed. Our “bust” didn’t happen – we bailed out the banks and they are bigger than ever. What’s more the bailout is now constant, $70 billion per month from the Fed alone.

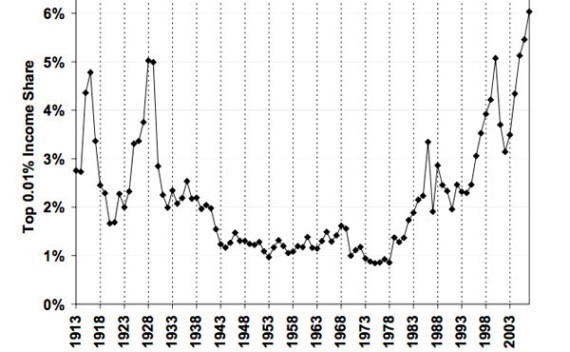

Money printing by central banks has driven the asset price bubble. Regulation has barely changed because the same vested interests “own” the regulators. The US central bank, the Federal Reserve Board (Fed) is privately owned, as are many other central banks. Corruption of the money system is now endemic with the Fed complicit in market manipulation and fraud. Potential triggers to start the collapse are many and various: dramatic one-day falls in stockmarkets, an oil shock caused by escalating conflict, a rise in interest rates, exposure of gold shorting to prop up the US dollar or European bank failures. Income inequality is now higher than its ever been recorded; the last time it was at anything like these levels was immediately prior to the Wall Street Crash in 1929 – thereafter, the inequality ratio plummeted. It’s been rising exponentially since the 1980s.

So what is to be done?

The Critical Thinking project, which emerged from Occupy London in January 2012, has been exploring these issues and the above summary is the result of extensive analysis. We are now developing a blueprint for a New Economy, which fosters greater equality, cooperation and fairness while working for the interests of all and a sustainable future. The New Economy is founded on three fundamental principles to eradicate the three fundamental flaws in the current system:

100% of surpluses (before labour or capital are applied) from land and resources are to be shared for the common good

Complete prohibition of interest

Unconditional citizens income to provide the means for a comfortable life for all

An economic system, founded on these principles will remove the systemic drivers of inequality, unsustainable growth, competition, conflict and environmental destruction. Interest free money would be created centrally to fund public housing and infrastructure. Rents on land would fund public services and a citizens income. Everyone will receive the citizens income which means that survival is no longer a preoccupation.

Paid employment becomes a choice rather than an obligation, balancing the power between employer and employee – no need for unions to protect workers rights, they can vote with their feet. Private enterprise, co-operatives and state owned utilities could operate in a mixed economy where the “winner takes all” doctrine, no longer applies. Income and other employment taxes could be abolished, along with VAT. It would solve the growing demographic problem, in the developed world, of rising pension costs – state pension and unemployment benefits would be unnecessary.

Critics will be quick to question affordability but they are thinking in terms of the current unfair distribution of income where the few “rent seekers” appropriate our birthright, through land rents and interest on illusory money. Applying these principles will make it affordable. Absence of interest will halve the cost of living and eliminate inflation. Gross income would equal net income (no tax). Highly educated people in banking, finance, law, accounting, public service etc. would be free to unleash their highly educated creativity to benefit mankind, as would everyone else. These ideas have been in existence for over a century. It’s about time we applied them to begin to eliminate many of the problems in the world which are symptoms of a broken economic system. A discourse on these issues is unlikely at Davos, which is a shame; the ruling elites and their lieutenants need not fear for their future. But they sure will, when the system collapses. Perhaps they just need to see the income inequality chart above to imagine the possible consequences and think differently. The alternative to our scarcity based civilisation, destined to collapse, is a co-operative civilisation in which these systemic drivers of inequality, violence and misery are absent.