Many Americans today do not fully understand the depth of the problem facing the United States. Yet, if they looked into their own households, they would see that the situation cannot be sustained much longer.

The average U.S. household now carries around $105,000 in debt. Mortgages account for the largest share, followed by auto loans, student loans, credit cards, and other types of consumer debt.

The Big Picture: Then and Now

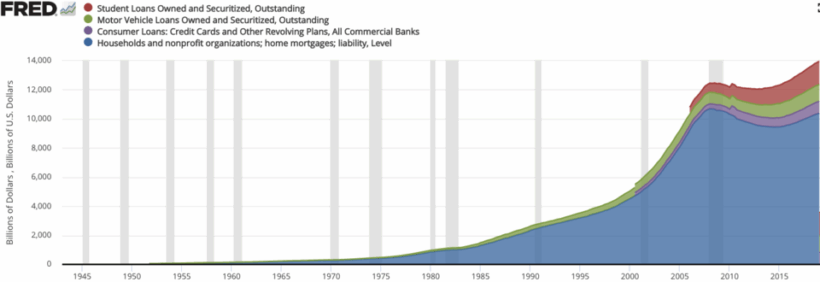

Consumer debt: mortgages, credit cards, motor vehicle, and student loans. Credit: US Federal Reserve Board of Governors, FRED

In 1950, household debt was strikingly different:

- Debt-to-GDP: Household debt was only about 25–30% of GDP, compared to nearly 75–80% today.

- Mortgages: After WWII, the GI Bill and suburban expansion fueled a homeownership boom. Mortgage balances were modest: the average new loan was $7,000–8,000 (about $90,000 in today’s dollars).

- Consumer credit: Tiny by comparison. In 1950, total non-mortgage consumer credit was just $20 billion nationwide—around $130 per person (≈$1,600 today). This was mostly used to finance cars and household appliances. Credit cards didn’t even exist yet—BankAmericard (later Visa) only launched in 1958.

In short: debt existed, but it was manageable and structured around building the future, not mortgaging it away.

From Freedom to Enslavement

Today, many Americans have lost their freedom, chained to debt. Their future is not about growth but about paying back the lifestyle of the past. People spend tomorrow’s earnings to finance today’s consumption—and corporations and banks profit from this cycle.

The real crisis is not financial but philosophical: a crisis of adaptation. As philosophy sometimes defines it, intelligence is the faculty of adaptation in any situation. Yet most of us have lost that ability. It is not about how much money you have, but whether you can live within your means, adjusting to the present without sacrificing the future.

Why do corporations and banks wield so much power? Because we give it to them. We hand over our present and future, allowing them to decide our lifestyle. They control the money we don’t have but desperately need, and in turn, they dictate what we—and even our politicians—do.

The Way Forward

If America truly wants to be “great again,” the solution is not political slogans but practical discipline:

- Stop relying on the plastic card.

- Avoid unnecessary loans.

- Live within your budget.

And beyond personal responsibility, we must also organize collectively. True greatness means fighting for decent living conditions adapted to our times—what could be called a growing adaptation toward coherence.

Ultimately, the focus should not be on changing our politicians, but on transforming ourselves. Only by reclaiming our capacity to adapt—individually and collectively—can we break free from the cycle of debt and restore real freedom.