Article published by Occupy London, Economics Working Group

“The Co-op Bank: Mutual or Burst

Since the appalling news of a Co-op Bank takeover by US hedge “vulture” funds (Aurelius Capital and Silver Point Capital) a growing body of Co-op members and bank customers are rallying to restore co-operative control and underpin the bank’s commitment to ethical investment.

Background

The future of the Co-op Bank has been in doubt since announcing losses arising from the acquisition of the Britannia Building Society. Once the government made clear it would not bail out the Co-op Bank its credit rating shattered and the vulture funds bought up Co-op debt – interest-paying bonds at a lot less than the face value of £940 million.

Question: Which institutional investors sold out, and which banks put up the money for these asset strippers?

The Bank of England (Prudential Regulatory Authority) requires reduction of Co-op Bank debt of around £1bn by the end of 2013 and another £500mn in 2014 to cover likely Britannia losses.

Current Status

Last week the Co-op board announced it had no option but accept the vulture funds’ demand for a controlling equity stake – worth much more than £940m – in exchange for their Co-op Bank bonds followed by stock market floatation in 2014.

The Co-op Bank said ”failure to implement the recapitalisation plan may lead to regulatory intervention… & may even result in the bank no longer being able to continue as a going concern.”

Question: Would intervention be such a bad thing, and why preserve a bank co-operative in nothing but its name?

The Bank of England said “The BofE is in a position to rescue Co-op Bank, its depositors and core functions as a going concern, while forcing holders of £1.3bn of its bonds and preferred shares to provide the needed additional capital, should that be necessary”

We say…

Proposed Action

We need to beat hedge fund vultures at their own game and buy their pot of Co-op debt for a fraction of its £940 million face value. The price will be reduced as fast as Co-op deposit account-holders withdraw their money whilst leaving their accounts open. The vulture funds financed their bids with loans and we too could seek low-interest loans from unions, churches, charities and sympathetic pension funds (even state institutions and local authorities by responsibly utilising funds from the BofE’s next round of QE).

Meanwhile, the Co-op board are scheduled to announce their recapitalisation plans by the end of October 2013, so now is the time to pile on the pressure.

OUR DEMANDS

Any privatisation of the Co-op Banks is a clear breach of the defining Co-operative’s commitment as ’a group of people acting together to meet the common needs and aspirations of its members, sharing ownership and making decisions democratically…not about making big profits for shareholders, but creating value for customers.’

1. Divest Aurelius Capital and Silver Point Capital of any debt, equity and/or other interest in the Co-op Bank

2. Scrap plans for a Co-op Bank stock market floatation

3. Revitalise the Co-op Bank under fully mutual ownership.”

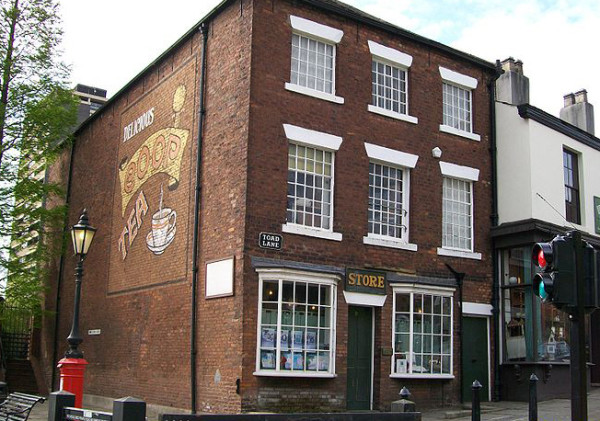

The Rochdale Pioneers – Official Trailer

“Set in 1844, The Rochdale Pioneers tells the story of a group of working-class people from Rochdale who band together to change the unfair society in which they live. Pooling their resources, they manage to get enough money together to open their shop, with a pledge to share profits fairly with their customers. Thus the ‘Co-op’ was formed and history was made.” Film 4