In the late summer of 1998, in the wake of the Asian financial crisis, a group of German and French professors of economics organised at the University of Bremen in Germany a seminar to discuss ways to re-regulate the international financial markets. The theme could not have been timelier:

The disaster of the Mexican crisis in late 1994 had already shaken the foundations of neoliberalism in Latin America, the Asian crisis repeated the same symptoms, and it was already clear that some hedge funds, such as the Long Term Capital Management, which had been heavily speculating in Russian bonds, would sooner than later go bust.

Already at that time it was clear that the moral hazard, the irresponsibility of speculating investors as intrinsic component of international financial markets, their absolute confidence that the noxious consequences of fraudulent actions would be paid for by the state, was the directing principle of such markets.

Systematic Risk

After several days of deliberations, the European economists concluded, sadly, that only a major global crisis would convince governments to regain control of the financial markets, in a way similar to the Keynesian-led regulation introduced after the crisis of 1929.

Almost 15 years and several crises later, including the collapse of the real estate market in the U.S. in 2007, which provoked the present global financial and economic calamity, it is easy to say that the conclusion of the Bremen seminar in 1998 could not have been more naïve. Not that the economists’ analysis was wrong: quite the contrary.

What today is considered standard knowledge on financial crisis was already their bread and butter. What today are considered indispensable steps to regulate financial markets, they advocated already at the time. The measures included in the so-called Basle III agreement – the global regulatory standard painfully negotiated since 2008 and supposed to be full in force by 2019 – were included in the Bremen seminar’s recommendations.

Already at the time it was conventional wisdom among economists participating in the seminar that retail and commercial banking had to be separated from investment banking; that investment banks would have to increase their own capital as to cover their own risks; that the state would have to limit the size of banks and investment funds and their interconnection to avoid the “systemic risk”; that investment banks should not be allowed to influence equities trading to reduce corruption; that the so called liquidity coverage ratio had to be high enough to allow banks to survive a relative long period of stress; and the like.

In fact, all that was conventional wisdom among numerous independent economists beyond the circle of participants, cognizant of financial crises, and not a hermetic science reserved for a happy few. In 1998, you could have known all about financial crises and their consequences if only you cared. When investment bankers, fund managers, and politicians today say that they were surprised by the crisis of 2007, they are lying.

Political Power of Banks, Investment Funds

The Bremen seminar economists’ problem was not analytical or factually incorrect. The problem was that they did not fully grasp the political power of banks and investment funds, and the cowardice of politicians supposed to regulate the financial markets.

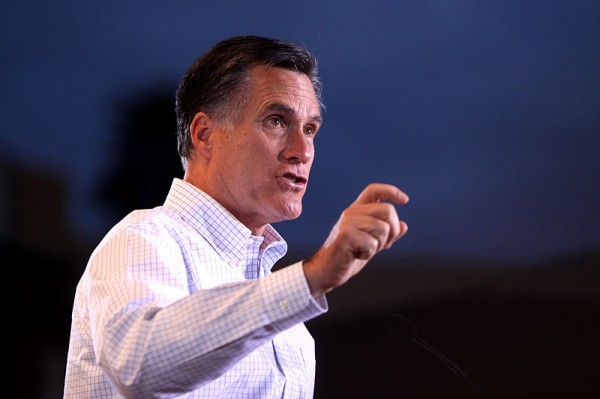

The best – actually, the worst – example is the U.S. and the Barack Obama administration. Who could have imagined in 2007 that in 2012 a former manager of a hedge fund – Mitt Romney is indeed the quintessential vulture capitalist – would have such enormous chances to become elected president of the country?

How come that a society still suffering the enormous burden caused by the irresponsible behaviour of bankers and speculators would be willing to put one of them as the head of the state, and give him carte blanche to continue destroying the nation’s common basis? Why is it that that society continues to allow criminal speculators to pocket tens of millions of dollars in “bonuses”, while at the same time sees their victims as guilty and condemned to abject poverty?

There is only one explanation: Wall Street – that is, the financial markets – won the war of explaining the crisis, mostly because those who were supposed to be its strongest opponents, people like Barack Obama, preferred to stay out of the way instead of standing up and fighting. What did Obama say when a reporter brought up the names of Jamie Dimon (CEO of JPMorgan Chase) and Lloyd Blankfein (CEO of Goldman Sachs): “I know both those guys, they are very savvy businessmen.”

Savvy businessmen? Blankfein is the guy who in 2006, only months before the financial crisis broke out, “earned” 54 million U.S. dollars. He is the guy who, in 2009, two years into the global crisis and only months after the state had been forced to channel hundreds of millions of dollars to repair Blankfein’s and his peers’ follies, had the chutzpa to describe his job as a banker as “God’s work”.

No wonder then, that the voters who once believed that Obama really meant “change” are disillusioned, and the other fools may prefer the hedge fund manager, and keep praying, in the vain hope that God will actually come to rescue their “own country”.

Original article in IDN: http://www.indepthnews.info/index.php/global-issues/1237-imagine-a-hedge-fund-manager-as-us-president